Executive Summary

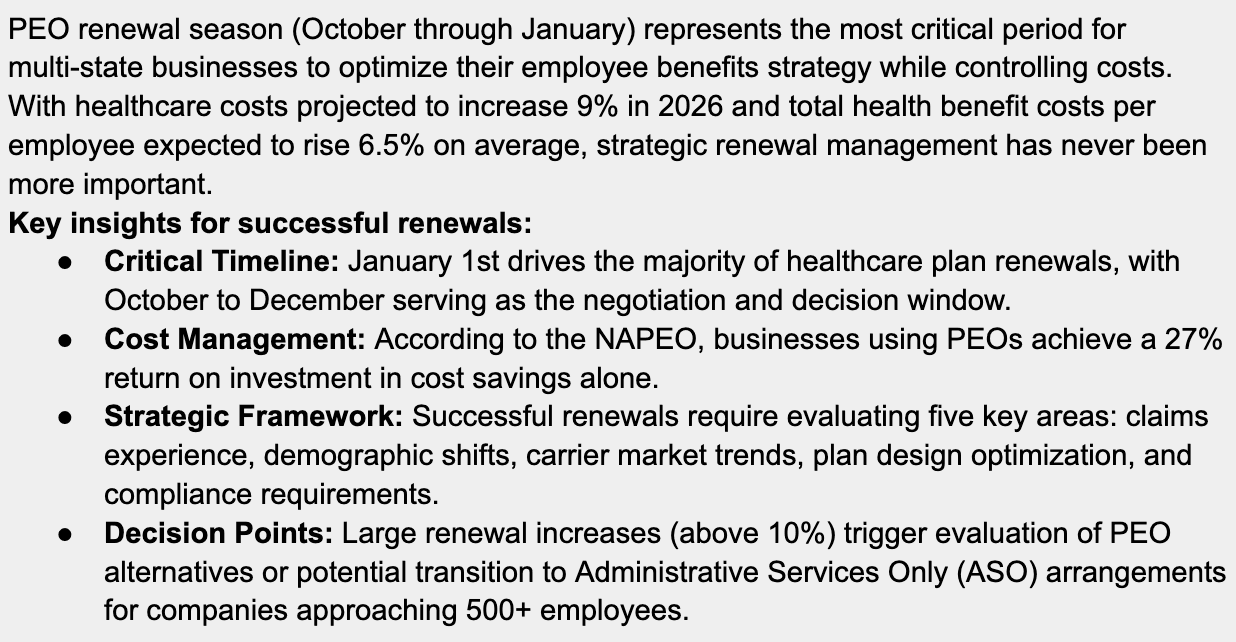

Why PEO Renewal Season Matters

October to January marks the most critical time in the PEO lifecycle: renewal season. Most healthcare plans renew on January 1st, aligning with calendar-year benefits and driving key decisions on employee benefits costs, compliance posture, and operational efficiency. For SMBs with 20–500+ employees, this period presents both risk and opportunity. The opportunity lies in optimizing benefits packages, controlling costs, and ensuring compliance across multiple jurisdictions.

Modern PEOs like Niural turn renewals into a strategic advantage using AI-powered payroll, real-time compliance, and integrated benefits. Unlike outdated legacy systems, Niural’s AI-native platform offers predictive analytics and live dashboards to guide smarter, faster decisions. According to NAPEO research, businesses that use PEOs grow twice as fast, have 12% lower employee turnover, and are 50% less likely to go out of business.

Niural Advantage: Unlike legacy PEOs running on outdated 1980s-era systems, Niural's AI-native infrastructure provides real-time dashboards and predictive analytics that enable data-driven renewal decisions.

Understanding the PEO Renewal Cycle

PEO renewal cycles operate on 12-month terms with specific effective dates that align with broader benefits industry practices.

The January 1st Phenomenon

The prevalence of January 1st effective dates stems from practical benefits administration considerations. When renewal dates align with the calendar year, employees experience transitions in their deductible accumulations, FSA balances, and Health Savings Account (HSA) contributions. This alignment simplifies employee communication and reduces confusion during open enrollment periods.

Companies with "off-cycle" renewals, those effective on dates like June 1st or October 1st, often face challenges when mid-year plan changes become necessary to address cost increases. Limited carrier options and reduced negotiating leverage can result in less favorable outcomes.

Multi-State Compliance Timing

For businesses operating across multiple states, renewal timing becomes even more critical. Each state maintains distinct requirements for workers' compensation, unemployment insurance, and payroll tax filings. Niural's multi-state tax compliance capabilities ensure that renewal transitions don't create gaps in coverage or filing requirements across jurisdictions.

Open Enrollment Alignment

PEO open enrollment periods typically run from mid-November through mid-December for January 1st effective dates. This compressed timeline requires advance preparation and clear communication strategies to ensure employee participation and satisfaction.

Make sure to collect company data from the past 12-24 months to make an informed PEO renewal decision. (Source: Pexels)

What Drives PEO Renewal Rates?

Understanding the factors that influence PEO renewal rates enables businesses to anticipate changes and develop negotiation strategies. Unlike individual company renewals, PEO renewals benefit from large risk pools that can moderate the impact of individual claims experience.

Claims Experience and Demographics

Your company's claims history over the past 12-24 months significantly impacts renewal pricing. However, within a PEO structure, individual company claims are pooled with hundreds or thousands of other businesses, creating a stabilizing effect. This pooling effect provides protection for companies experiencing high claims by distributing risk across the collective group.

Demographic factors, including employee age, geographic distribution, and industry risk profiles, also influence pricing. PEOs with diverse client bases can better absorb demographic risks than individual company plans.

Carrier Market Trends and Medical Inflation

Broader healthcare market trends affect all renewal negotiations. According to the Business Group on Health's 2026 survey, employers predict healthcare cost trends will reach a median of 9% in 2026. Mercer research indicates this represents the highest increase since 2010, driven by catastrophic claims and costly medications, including GLP-1 drugs. PEO healthcare renewal negotiations benefit from the collective bargaining power that individual companies cannot achieve.

Negotiable vs. Non-Negotiable Elements

What you can influence:

- Plan design features (deductibles, copayments, network options)

- Voluntary benefits additions or modifications

- Wellness program participation incentives

- HSA/HRA contribution strategies

What you cannot directly control:

- Underlying medical trend factors

- Carrier network changes

- Regulatory compliance costs

- Base demographic rating factors

Decoding Your Renewal Notice

PEO benefits renewal notices typically arrive in October and contain several key components:

Current vs. Proposed Rates: Compare percentage increases across all benefit categories, not just medical coverage. Dental, vision, and voluntary benefits may have different trend factors.

Claims Experience Summary: Review your company's utilization patterns and any significant claims that may have influenced pricing.

Plan Design Changes: Identify any modifications to coverage levels, network access, or administrative procedures.

Compliance Updates: Note any regulatory changes affecting coverage requirements or administrative processes.

PEO Renewal Process: Step-by-Step Timeline

A structured approach to PEO renewal helps maximize savings and optimize benefits. Here’s a high-level timeline for strategic renewal execution:

October: Assessment & Research

- Weeks 1–2: Review renewal documents from your current PEO. Analyze cost increases and plan changes. Niural’s real-time dashboards simplify data analysis with instant access to utilization and cost trends.

- Weeks 3–4: Research alternative PEOs and request competitive quotes. Prioritize transparency, cost control, and service quality.

November: Strategic Analysis & Negotiation

- Weeks 1–2: Conduct a cost-benefit analysis, factoring in admin fees, benefits costs, compliance, and service quality.

- Weeks 3–4: Negotiate with your current PEO while evaluating other providers. Niural offers personalized support, unlike many larger providers with limited client focus.

December: Finalization & Enrollment

- Weeks 1–2: Select your PEO and begin transition planning if switching.

- Weeks 3–4: Communicate changes to employees and launch open enrollment. Niural’s HRIS automation streamlines this process.

January: Go-Live & Monitoring

- Weeks 1–2: Monitor payroll, benefits, and compliance to ensure a smooth start. Niural’s AI-powered payroll prevents common errors.

- Weeks 3–4: Assess early performance and establish ongoing monitoring for the new year.

Strategic Opportunities During PEO Renewal

Renewal season is a prime opportunity to enhance benefits while controlling costs. Forward-thinking companies use this time to improve employee satisfaction and business performance.

Benchmarking Beyond Cost

Go beyond premium comparisons, evaluate service quality, tech capabilities, and strategic value.

- Service Performance: Assess payroll accuracy, compliance, responsiveness, and HR support. Niural’s proactive compliance tools identify issues before they escalate.

- Technology: Legacy PEOs often rely on outdated systems. Niural’s AI-native platform offers intuitive, automated workflows that improve efficiency and satisfaction.

- Scalability: Ensure your PEO can grow with your business. Niural supports effortless transitions from PEO to ASO as companies expand.

Plan Optimization Levers

- Cost-Sharing Strategy: Balance premiums and out-of-pocket costs. Pairing high-deductible plans with HSA contributions can reduce spending while maintaining value.

- Network & Rx Management: Ensure national network adequacy and implement formulary controls to manage pharmacy costs.

- Voluntary Benefits: Add low-cost options like critical illness or financial wellness programs. PEO clients are more likely to offer retirement plans and supplemental benefits.

- HSA/HRA Optimization: Leverage employer contributions and tailored HRA designs to boost value and manage costs.

Communicating Changes to Employees During Open Enrollment

Effective communication during PEO open enrollment boosts participation, reduces confusion, and drives employee satisfaction. Clear, timely messaging is key to a smooth renewal process.

Key Communication Strategies

- Multi-Channel Outreach: Use email, print, and virtual meetings to reach all employees.

- Personalized Impact: Share individual cost comparisons and examples tailored to different family and usage scenarios.

- Decision Support Tools: Provide calculators, plan comparison charts, and interactive guides to help employees make informed choices.

Driving Employee Engagement

- Educational Webinars: Host live and recorded sessions explaining changes, new options, and how to enroll.

- Benefits Fairs: Offer virtual or in-person events with access to benefits specialists for Q&A.

- Peer Champions: Recruit trained employee ambassadors to provide peer-to-peer support during enrollment.

Best Practices for Change Management

- Start Early: Begin communication weeks in advance to allow time for preparation and reduce last-minute stress.

- Be Transparent: Share the reasons behind plan changes; cost pressures, market shifts, or strategic goals.

- Offer Ongoing Support: Continue assistance post-enrollment to resolve issues and support employees during the transition.

Evaluate all PEO options available to you, ensuring they align with the needs of today’s evolving business landscape. (Source: Pexels)

What If You Get a Large Increase?

Significant PEO renewal rate increases, typically defined as 15% or higher, require immediate strategic response. While some increase is normal given healthcare inflation trends, excessive increases may signal underlying issues or opportunities for alternative arrangements.

Immediate Assessment Steps

- Claims Analysis Deep Dive: Request detailed claims reporting to understand what drove the increase. Large claims from specific individuals or departments may be one-time events that don't reflect ongoing risk.

- Market Comparison: Obtain competitive quotes from alternative PEOs to determine if the increase reflects broader market trends or provider-specific factors.

- Plan Design Review: Evaluate whether plan modifications could reduce costs while maintaining acceptable coverage levels. Sometimes modest design changes can significantly impact premiums.

Critical Questions for Your PEO

- Renewal Methodology: "How do you calculate renewal rates, and what factors contributed to our specific increase?"

- Claims Impact: "Which specific claims or utilization patterns drove our rate change, and are these likely to continue?"

- Alternative Options: "What plan design modifications could reduce our costs while maintaining core coverage?"

- Future Projections: "What renewal trends should we expect over the next 2-3 years based on our risk profile?"

- Negotiation Flexibility: "What options do you have to modify this renewal offer?"

When to Explore PEO Alternatives

- Consistent Above-Market Increases: If your PEO consistently delivers renewal increases significantly above market averages, alternative providers may offer better value.

- Service Quality Issues: Poor payroll accuracy, compliance failures, or inadequate customer service may justify a change regardless of cost considerations.

- Technology Limitations: Outdated systems that impede efficiency or user satisfaction represent hidden costs that modern platforms can eliminate.

- Growth Constraints: If your current PEO cannot accommodate your expansion plans or lacks capabilities in target markets, a transition may be necessary for strategic reasons.

PEO → ASO Transition Decision Framework

Companies approaching 500+ employees should evaluate PEO vs ASO arrangements during renewal periods. Key decision factors include:

- Cost Comparison: ASO arrangements may offer cost advantages for larger groups, but require internal administrative capabilities that smaller companies may lack.

- Risk Tolerance: ASO arrangements transfer more risk to the employer, including claims volatility and compliance responsibility.

- Administrative Capacity: Successful ASO management requires dedicated HR and benefits administration resources that may not be cost-effective for smaller organizations.

- Transition Complexity: Moving from PEO to ASO involves significant administrative changes that must be carefully managed to avoid disruption.

Checklist: How to Prepare for a Smooth Renewal

Use this comprehensive checklist to ensure thorough preparation for your PEO renewal process:

☑ October Preparation (Weeks 1-2)

- Owner: HR/Benefits Manager | Timing: Early October

- Review current PEO contract terms and renewal notice requirements

- Gather 12-24 months of claims and utilization data

- Document current service quality issues or concerns

- Assess employee satisfaction through surveys or feedback sessions

☑ Market Research (Weeks 3-4)

- Owner: Finance/Procurement Team | Timing: Mid-October

- Request competitive quotes from 2-3 alternative PEO providers

- Research PEO renewal rate histories and transparency practices

- Evaluate technology platforms and user experience demonstrations

- Assess compliance capabilities across all operating states

☑ Strategic Analysis (November Weeks 1-2)

- Owner: Leadership Team | Timing: Early November

- Calculate the total cost of ownership for all PEO options

- Evaluate service quality and technology differentiators

- Assess scalability and growth accommodation capabilities

- Review compliance track records and risk management approaches

☑ Decision Framework (November Weeks 3-4)

- Owner: Executive Team | Timing: Mid-November

- Establish decision criteria and weighting factors

- Conduct final negotiations with preferred providers

- Make preliminary provider selection pending final terms

- Develop a transition timeline if changing PEOs

☑ Employee Communication (December Weeks 1-2)

- Owner: HR Team | Timing: Early December

- Develop a comprehensive communication strategy and materials

- Schedule employee meetings and educational sessions

- Prepare decision support tools and comparison resources

- Launch open enrollment communication campaign

☑ Enrollment Management (December Weeks 3-4)

- Owner: Benefits Administration | Timing: Mid-December

- Monitor enrollment participation rates and address gaps

- Provide ongoing employee support and question resolution

- Coordinate with PEO for enrollment data validation

- Prepare for January 1st implementation activities

☑ Implementation Support (January Weeks 1-2)

- Owner: Operations Team | Timing: Early January

- Monitor payroll processing accuracy and timing

- Verify benefits coverage activation and ID card distribution

- Address any implementation issues or employee concerns

- Establish ongoing performance monitoring processes

☑ Performance Assessment (January Weeks 3-4)

- Owner: Leadership Team | Timing: Late January

- Evaluate initial performance against expectations

- Document lessons learned for future renewal cycles

- Establish quarterly review processes for ongoing optimization

- Plan strategic initiatives for the new plan year

Your checklist should be thorough, covering every aspect to ensure an informed decision. (Source: Pexels)

FAQ: PEO Renewals

Q: When should I start preparing for my PEO renewal?

A: Begin at least 90 days before your renewal date, early October for January 1st renewals. This allows time for market research, analysis, and negotiation.

Q: What constitutes a "good" PEO renewal rate increase?

A: Increases under 8% are typically favorable. With 2026 healthcare costs projected to rise 9%, anything above 15% should trigger a review of alternatives.

Q: Can I negotiate my PEO renewal rates?

A: Yes. Focus on plan design, admin fees, and service enhancements. Base medical trends are often non-negotiable, but other components offer room for discussion.

Q: Should I consider changing PEOs during renewal season?

A: Consider changing if you face high rate hikes, poor service, or outdated tech. Niural minimizes switching friction with an optimized transition process.

Q: How do PEO renewal rates compare to individual company renewals?

A: PEOs offer more rate stability through pooled risk. NAPEO reports a 27% ROI from cost savings alone for PEO users.

Q: What happens if I miss my PEO renewal deadline?

Missing it may lead to automatic renewal with less favorable terms and limited plan options. Set a renewal calendar to stay ahead.

Q: When should I consider transitioning from PEO to ASO?

A: Consider PEO vs ASO evaluation when approaching 500+ employees, experiencing consistent cost disadvantages, or requiring greater benefits customization than PEO structures allow.

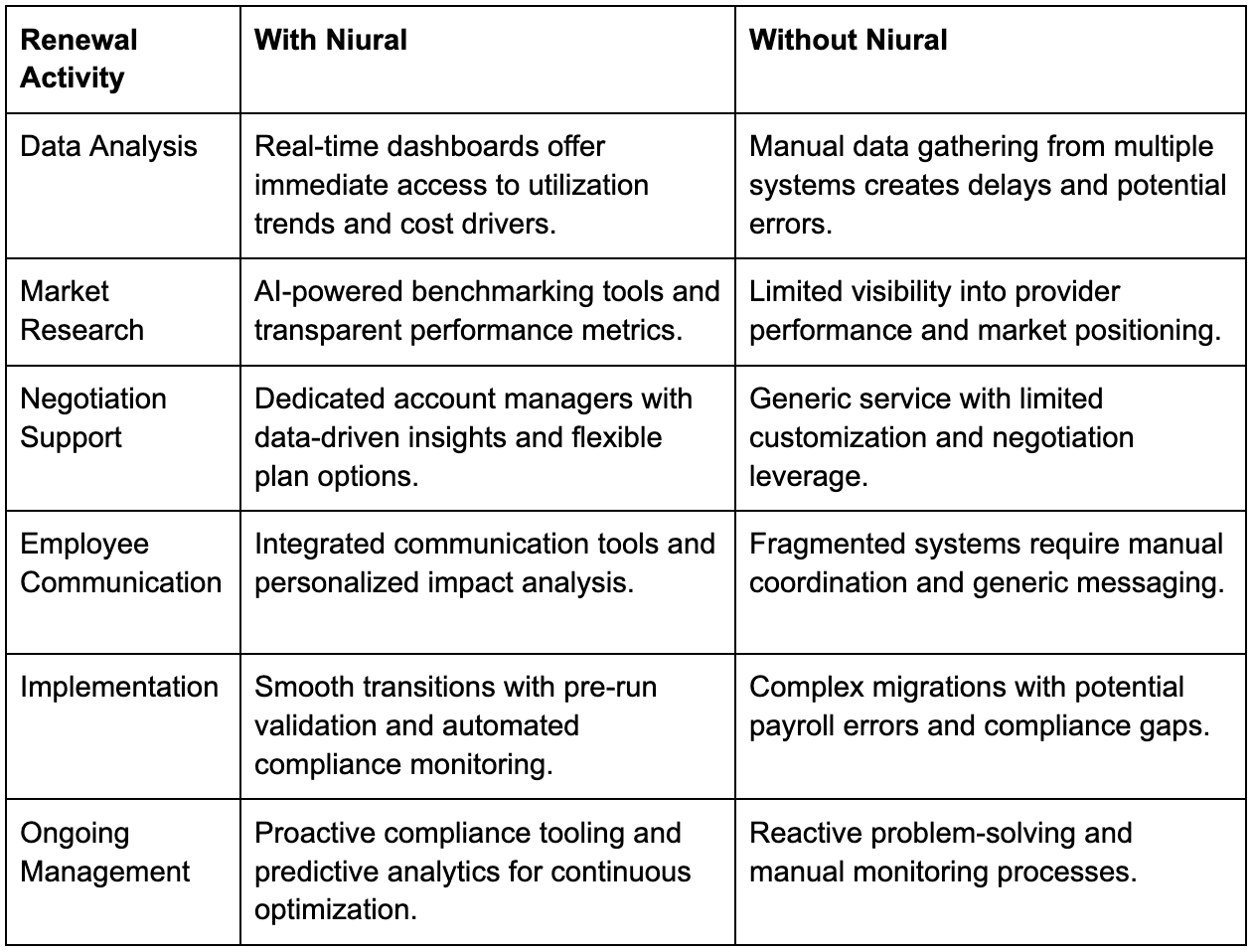

Comparison Table: With Niural vs Without Niural

PEO renewal season represents far more than an administrative requirement—it's a strategic opportunity to optimize your benefits program, control costs, and enhance employee satisfaction. The October through January renewal period demands proactive preparation, thorough analysis, and clear decision-making frameworks to achieve optimal outcomes.

Ready to experience the difference that modern PEO technology can make for your renewal process? Explore how Niural's AI-native platform can simplify your benefits administration while delivering superior cost management and employee satisfaction.

Disclaimer: This blog is based on information available as of September 2025. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. You should consult your own tax, legal, and accounting advisors before engaging in any related activities or transactions.